Introduction to the Purse Payment API

Who we are?

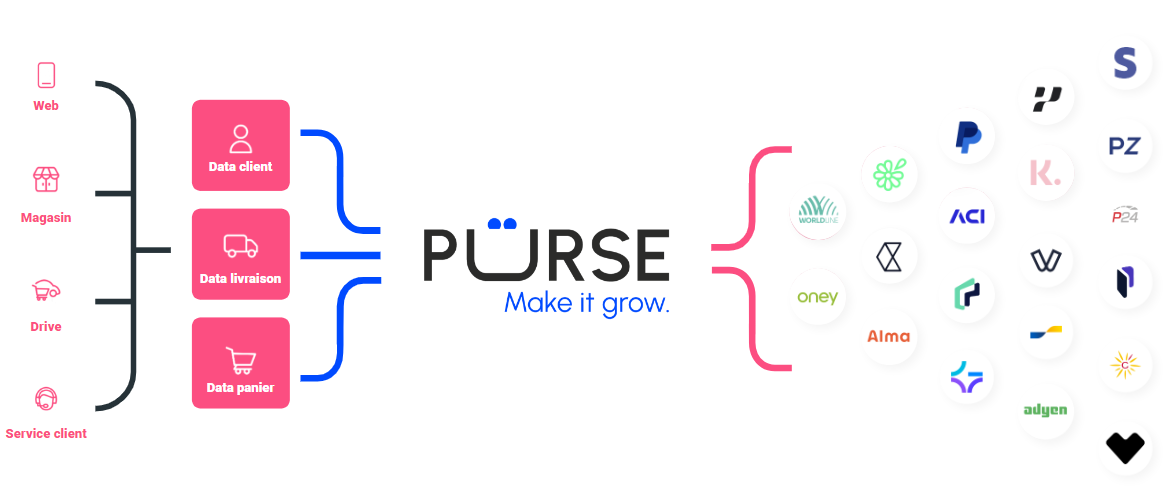

Purse is an orchestration payment platform.

- Purse API simplifies this process acting as a gateway, by handling the connection between the merchant and the payment ecosystem.

What do we provide?

Using a large variety of features, Purse acts as an orchestrator between merchants and the payment ecosystem.

It gives you a powerful payment management solution designed to simplify the integration of multiple payment methods into a single, unified system :

| Feature | Description |

|---|

| Customizable Checkout System | User-friendly checkout experience |

| Unified API | One integration for multiple payment providers |

| Secure Vault | PCI-compliant card data storage |

| Advanced Routing | Optimize transaction success rates |

| Real-Time Monitoring | Full visibility on payment flows |

Each component is designed to simplify your integration while providing a secure and flexible payment solution.

Through this documentation, we will guide you on how to use Purse's API and its features to its full potential and allow you to enhance your payment process.

Understand key players in in the value chain of payment

A standard card online transaction, involves four main parties:

1️⃣ The Card Holder – The individual making the payment

2️⃣ The Retailer (Merchant) – The business offering a product or service

3️⃣ The Acquirer (Merchant’s Bank) – Processes payments and routes through card networks

4️⃣ The Issuing Bank (Customer’s Bank) – Issues the card and validates the transaction

How a payment transaction works?

A typical online payment follows this flow:

1️⃣ Customer enters payment information

2️⃣ The request is sent to a PSP or alternative method (wallet, BNPL, etc.)

3️⃣ PSP (if applicable) sends the transaction to the acquirer

4️⃣ Acquirer contacts the issuing bank

5️⃣ The bank checks and approves (or declines) the transaction

6️⃣ If approved, funds are transferred and the merchant is notified