Purse API offers a variety of features that optimize payment management for businesses.

This section presents real-world use cases demonstrating how merchants can leverage Purse API.

Optimized Checkout

Use case

Customers abandon purchases due to complex, slow, or unoptimized payment forms.

Solution: Purse Checkout System

A ready-to-use payment form that integrates seamlessly into merchant websites.

Supports multiple PSPs with a unified interface.

Fully customizable UI, allowing merchants to match their branding.

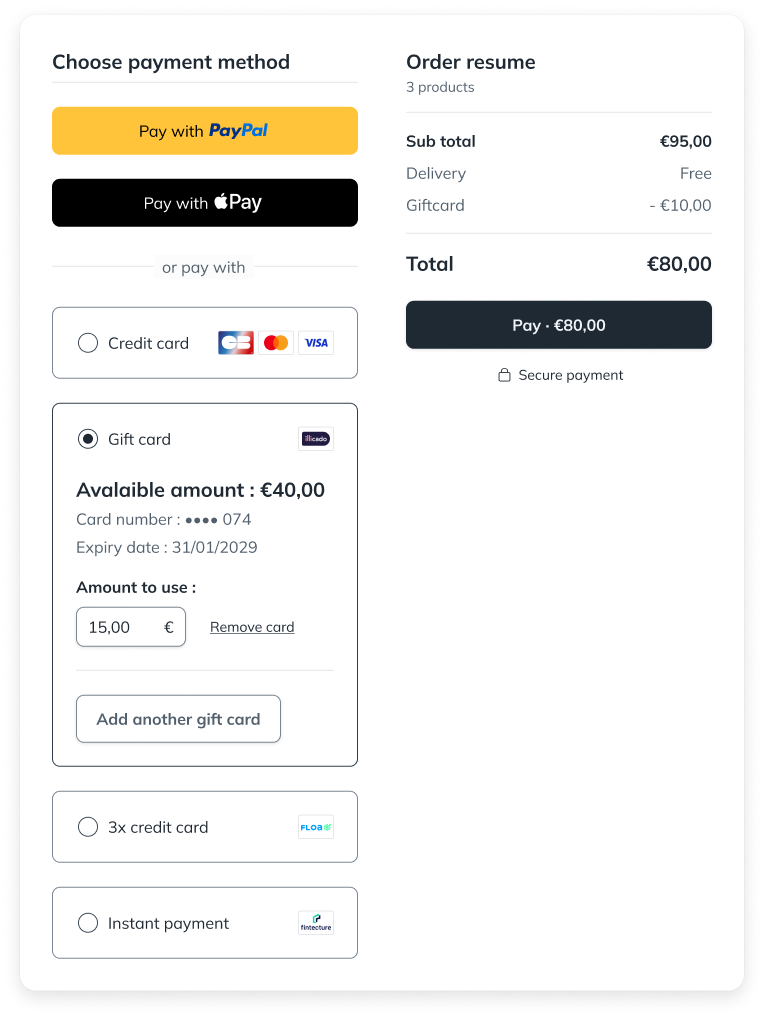

Example : A Purse Checkout Widget

Multi-Payment Flow

Use case

Shoppers increasingly use mixed payment options: part gift card, part credit card, or split across cards.

Solution: Purse Checkout and Multi-Payment Scenarios

Allows partial payments: customers can combine gift cards, credit cards, and other methods.

A customer wants to use a €15 Illicado card on a 95€ cart.

- The system detects the remaining balance and prompts a complementary payment method.

- The checkout continues seamlessly with a second card.

A multi-payment flow checkout example with a gift card and a credit card

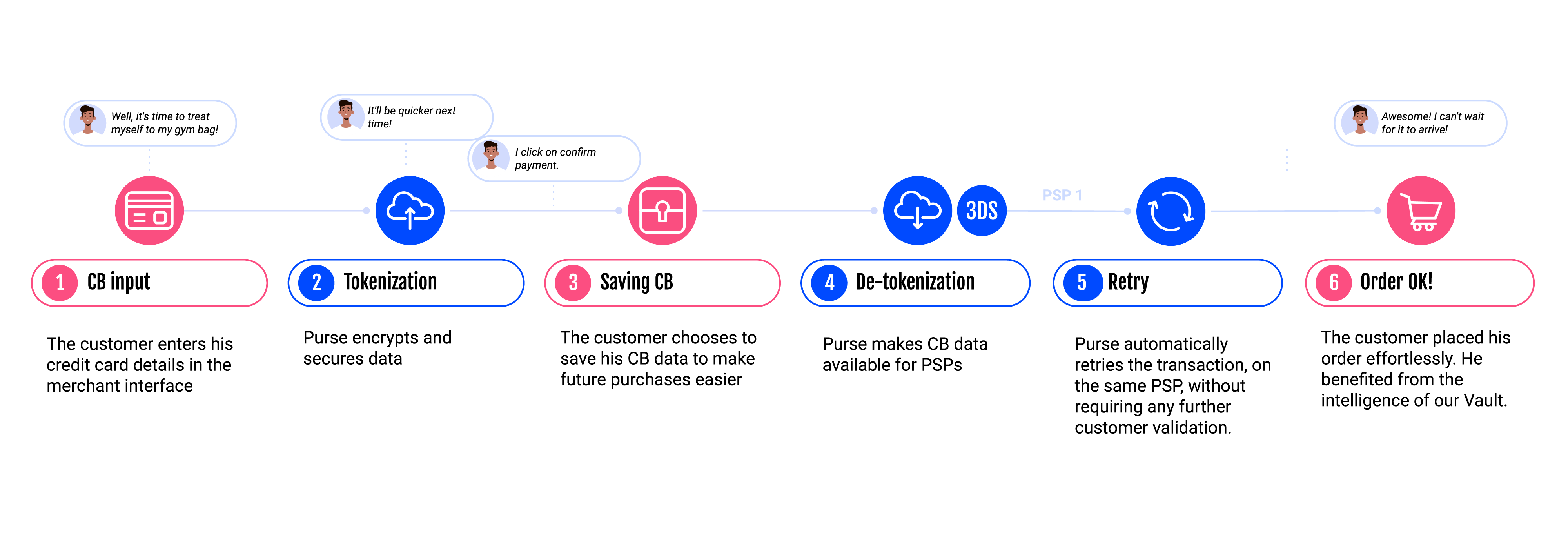

Payment Routing & Retry System

Use case

Transactions fail due to PSP downtimes or card restrictions, leading to lost revenue.

Solution: Dynamic PSP Routing & Retry

Bin Routing → Automatically directs transactions to the best-performing PSP.

Retry Mechanism → If a transaction fails, Purse API can retry the operation on the transaction without user intervention.

A travel booking platform uses Purse API to automatically route transactions based on card BINs and retry failed transactions, ensuring a smooth payment experience.

Purse Managed 3DS Authentication

Use case

Card fraud and chargebacks create risks for merchants.

Solution: Managed 3D Secure Authentication via Purse API

- Enhances security & fraud prevention by verifying cardholder identity.

- Purse API manages 3DS authentication independently of PSPs.

- Works in combination with the PSP Backup system for uninterrupted payments.

An online service selling digital goods uses Purse API External 3DS to reduce fraud risks while ensuring compliance with Strong Customer Authentication (SCA) regulations.

Secure Payment Storage

Use case

Merchants handling credit card information must comply with PCI-DSS standards.

Storing and processing payment data can be complex and risky.

Furthermore, merchants have to deal with the PSPs' vault solutions, which can be cumbersome and time-consuming.

Solution: Purse Vault

A PCI-DSS compliant storage system for securely saving customer card details.

Merchants don’t have to manage sensitive data, reducing compliance risks.

Fully integrated into Purse API, requiring no additional setup.

Example : A subscription-based service needs to store customer card details for recurring payments.

With the Purse Vault, the service can store, retrieve, and process payments securely.

Subscription & Recurring Payments

Use case

A business offering subscription-based services (e.g., SaaS, streaming, monthly box) needs to charge customers automatically without requiring manual intervention for each payment.

However, for security and compliance reasons, the first transaction must be authorized by the customer.

Solution: CIT/MIT via Purse API

CIT (Client Initiated Transaction) → The customer authorizes the first payment.

MIT (Merchant Initiated Transaction) → The merchant can later trigger automatic payments.

Compatible with credit card payments, ensuring security with SCA (Strong Customer Authentication) using 3D Secure

Example :

A customer subscribes to a €20/month service.

The first payment (CIT) is processed with 3D Secure authentication.

Subsequent payments (MIT) are triggered automatically.

This authorizes future charges and ensures compliance with PCI-DSS & security rules.

For additional informations, you can check the CIT/MIT documentation.

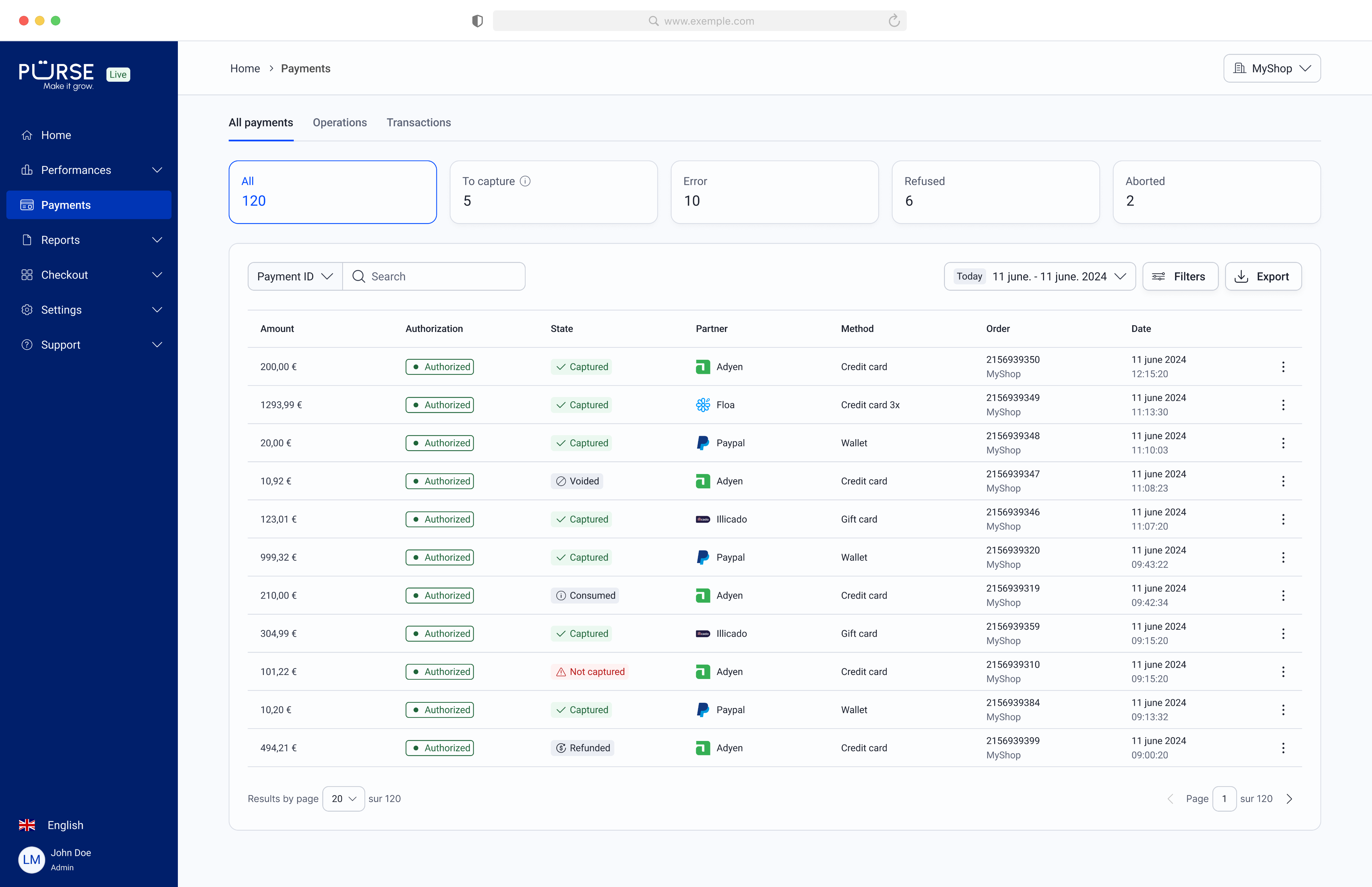

Transaction monitoring

Use case

Merchants lack visibility over payment performance and transaction success rates.

Solution: Purse API Dashboard

Real-time tracking of transactions, approvals, and failures.

Detailed analytics on authorization, authentication, and conversion rates.

Merchants can adjust payment settings dynamically for better results.

A SaaS company uses Purse Dashboard to analyze approval rates and fine-tune PSP settings to increase conversion.